R3 Strategist Outlines Blockchain’s Use Among 42 Banks

Why would banks cooperate with one another to use blockchain for transaction settlements? Isn’t such a plan no different from existing systems such as SWIFT?

These were among the questions asked of Kathleen Breitman, Senior Strategy Associate at R3CEV, at the conclusion of a talk she recently gave at a Blockchain in Finance meetup in San Francisco.

Antiquated systems still prevail

Kathleen addressed this core issue during her talk and afterwards, pointing out that the use of blockchain “takes antiquated systems that were built with political and technological constraints, and builds a single type of protocol everyone can rely on, and bring some assurance, and get people to align.”

Confusion is understandable during these very early days of blockchain—and more important—separating blockchain from its best-known pioneer, bitcoin.

There are 42 banks in the R3 consortium—which dates only to September 2015—including Barclay’s, Credit Suisse, Goldman Sachs, JP Morgan, and UBS. Company executives at these institutions would be among the last people in favor of a world proliferating with cryptocurrencies, which by definition exist well outside of the world’s traditional financial systems. R3’s effort, in fact, is independent of other well-known blockchain initiatives such as Hyperledger and Ethereum.

As I said, it ain’t bitcoin!!

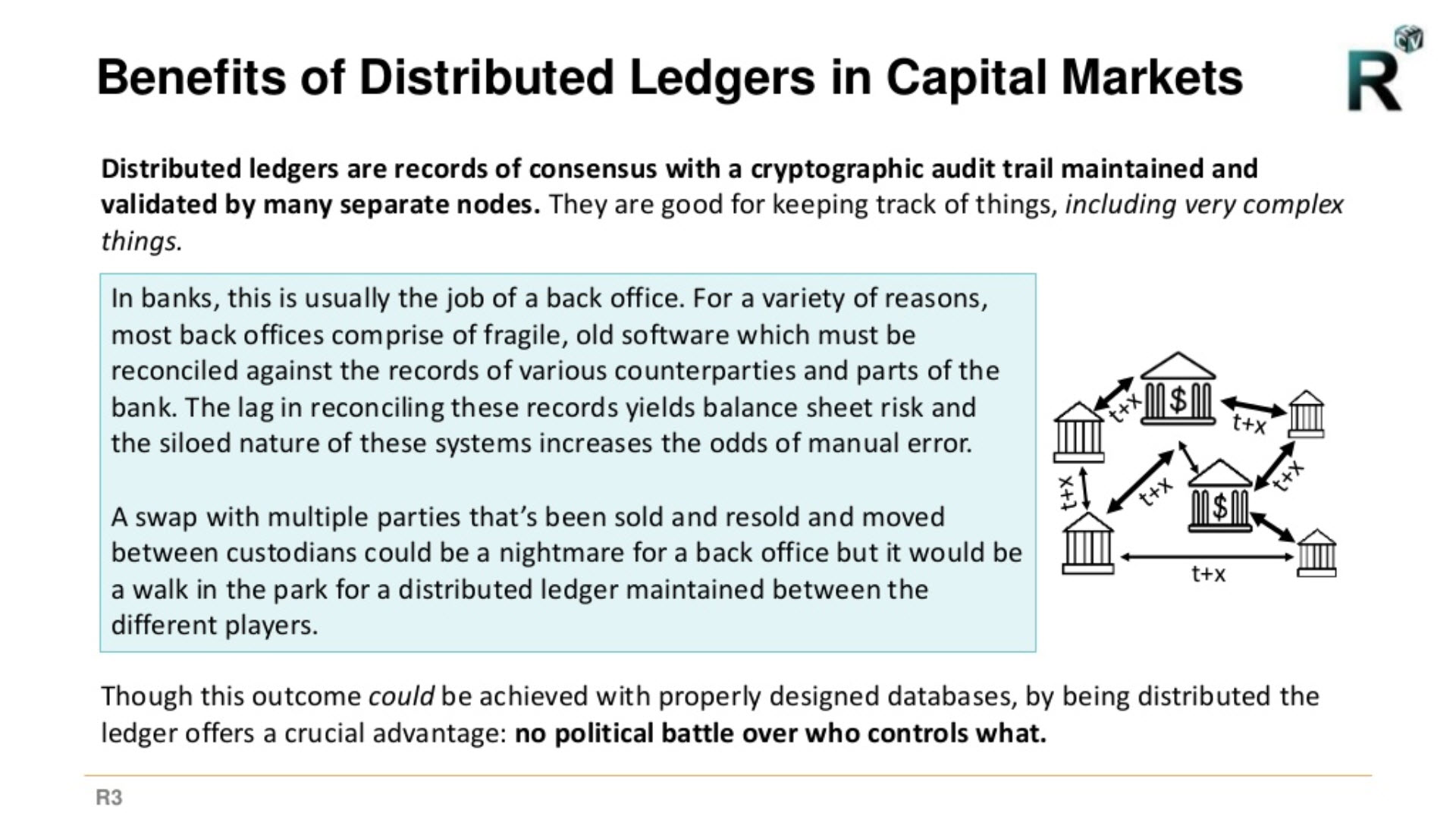

Kathleen acknowledged this, stressing that use of blockchain by members of the R3 consortium has nothing to do with bitcoin. Instead, the idea is to use its ability to have a single, peer-to-peer, immutable record of transactions. When and if implemented effectively, this will end inefficient, slow, laborious back-end transaction settlements by putting in place what is, in the final analysis, a 21st-century database.

“R3 members don’t have to worry about the process so much anymore.”

—Kathleen Breitman, R3

And where bitcoin is “permissionless” (i.e., anonymous) with no central authority, a blockchain settlement system as being created by R3 is comprised solely of trusted members who share its authority equally.

SWIFT, on the other hand, requires a third-party, centralized authority that slows down transactions and does not carry a single, immutable record; member banks need to be vigilant that their records match those of the banks with which they’re transacting.

Standardized data for the first time

“(R3 members) don’t have to worry about the process so much anymore,” she said during her presentation. “And outcomes can be achieved by a better-constructed database. That’s the big selling point.”

By standardizing data and the way it’s recorded, “(banks can finally) start to get rid of (old) systems in a coherent fashion. They’re also creating an apolitical system that can be spread among competing actors.”

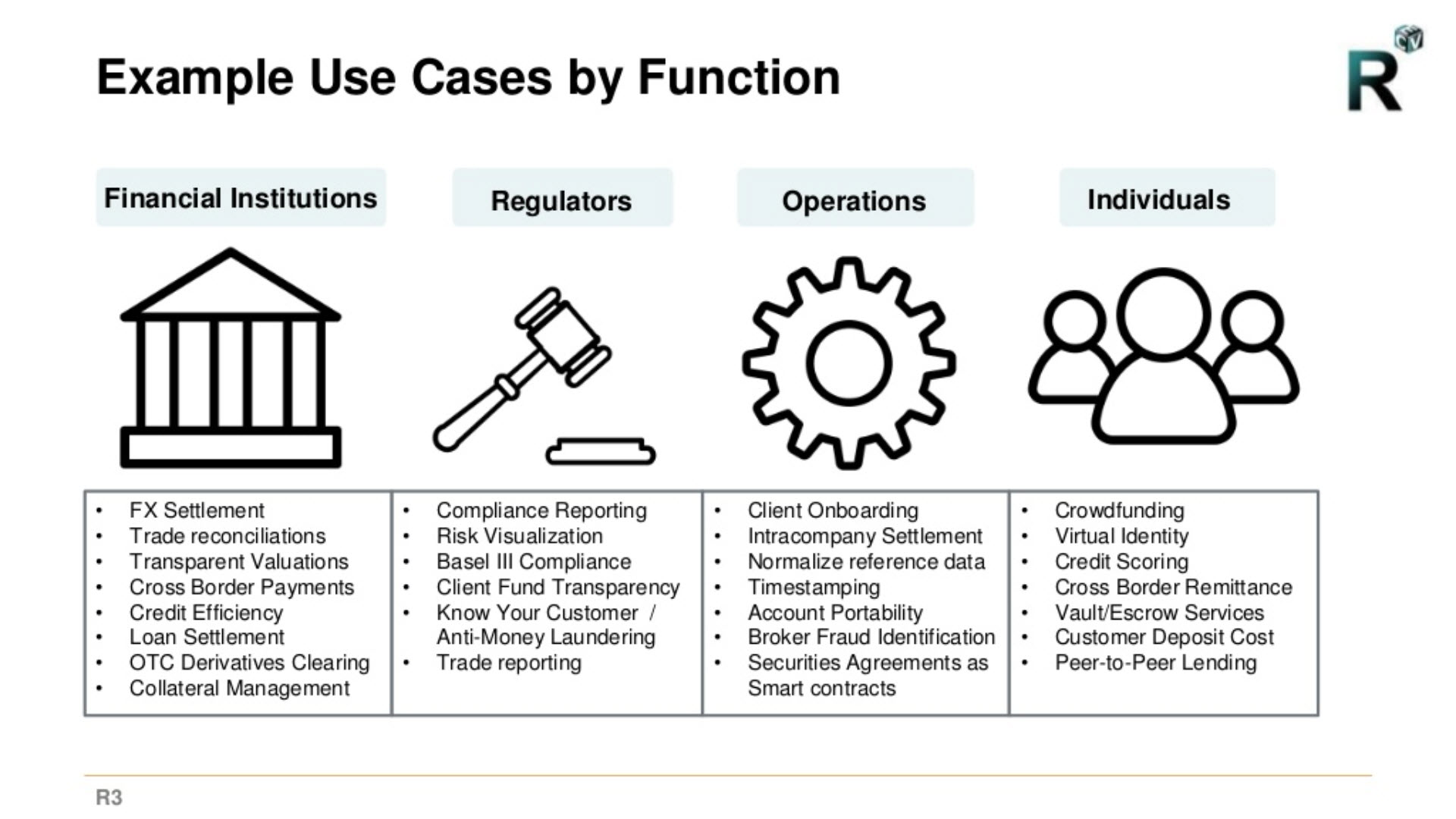

Kathleen described what she called three use-case archetypes:

- The first would have a lack of a centralizing authority, or the wish to operate without one. If there is a centralized authority in place, blockchain adds no value as it’s superfluous when in agreement with the authority and moot if not.

- The second archetype comes in robust regulatory environments, where blockchain’s timestamps can help investigators understand how and when transactions occurred.

- The third archetype comes with transactional processes. Although “blockchain is not sentient, so can’t identify things like conflicts of interest,” she said, they are useful in recording and validating the processes that follow many types of transactions.

Myriads of private blockchains to come

Kathleen’s presentation and R3’s project, remind one that the future of blockchain is hardly monolithic, or even multi-platform in the traditional understanding of the term. R3 is likely just one of what could be dozens, hundreds, or thousands of private blockchain implementations to come.

The financial services industry is taking an early lead with blockchain, as it does with most new technological developments. However, we can expect to see a proliferation of efforts in any number of industries. A quick review of potential use cases for just the Hyperledger Project alone provides a glimpse of this thinking.

We should thus imagine a world of proliferating blockchain technologies, forks, and “sidechains,” each with their own specific takes on how use cases will develop.

Additionally, Altoros CEO Renat Khasanshyn advised companies to look for “blockchains of blockchains” at a development meeting earlier this year. In this scenario, different institutions and groups of institutions develop ways to share the responsibility for distributed ledger metadata and transaction recording, while maintaning the security of their own transaction data.

Want details? Watch the video!

Table of contents

|

Related slides

Further reading

- The Royal Bank of Scotland Builds a Hyperledger Digital Wallet: the Lessons Learned

- Blockchain Adoption: Industry Requirements and the Role of Prototypes

- What Is the Future of Blockchain?

- Opinion: The Impact Blockchain Can Bring upon Finance and Banking and How It May Happen

- Blockchain Bottlenecks in Finance, Healthcare, and Insurance