Blockchain as a Single, Persistent Publish / Subscribe Queue

Existing challenges

“When I got interested in blockchain about a year ago, I became aware that the blockchain technology was going to change the chemical basis of life as we know it,” says Robert Boyd, a Principal Consultant at Haddon Hill Group.

During his session at the Hyperledger meetup, Robert was very optimistic about blockchain in finance, but as he pointed out, not everybody shared the same view. Back in May, the SWIFT institute released a report on blockchain, which ended with the finding of “little short-term payoff.” Furthermore, SWIFT and Accenture released another joint report, which tagged blockchain as “not mature enough.”

Robert listed general challenges to the adoption of blockchain in finance.

- Standardization

- There needs to be a consensus in how transactions are processed and how much data is shared.

- Cross-institution consensus mechanism

- There needs to be a secure centralized platform.

- Mining incentive and control

- Mining could be built into shared services in the blockchain.

- Integration

- A system of record needs to be included in any blockchain integration.

Adoption predictions

While it might seem too early for blockchain to make big waves in finance, Robert had some predictions in mind for long-term adoption.

- Early adopters

- 2016: Demonstration, tutorials, and proof-of-concept systems.

- 2017: Proofs-of-concept become pilots.

- 2018: Venture capitalist funded projects.

- Early majority

- 2019: Bank system refresh cycle funding.

- 2020: Funded projects join emerging communities.

Though blockchain seems poised to disrupt the financial world, there are already prime movers that are competing with traditional financial services. These include Facebook, Google, Amazon, Baidu, Alipay, and Tencent.

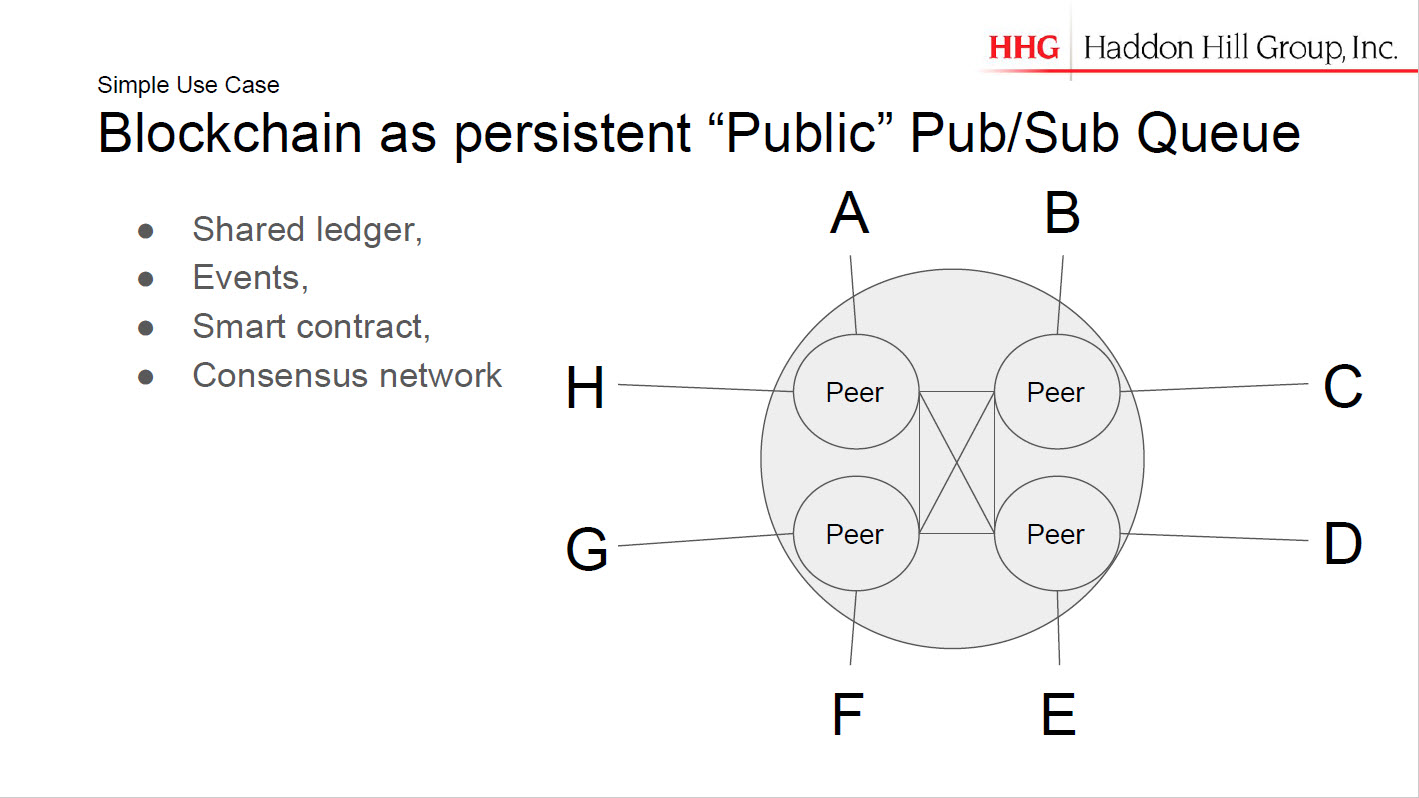

A public publish/subscribe queue

Despite the studies, Robert maintained interest in blockchain and praised it as a “great systems integration pattern, which is a publish and subscribe queue.” According to him, “those have been around for decades, used in many different ways”.

He describes a publish and subscribe queue as a system or a group of systems that want to talk to each other. If one system needed to send a message, it would simply publish to a node queue. Then, any other system that would want to receive the message would subscribe to the same queue.

According to Robert, the blockchain as a publish and subscribe queue has some technical advantages.

- Mutual ledger

- The ledger serves as a single source for all messages from any actor to another actor.

- Fewer point-to-point integrations and batch file exchanges.

- Metadata source is identified in the message itself.

- Distributed

- Better availability as the chain persists so long as one node remains active.

- Immutable persistent messages

- One agreed source as part of the overall financial services system upgrade replaces multiple file archives and simplifies audit process.

- Data is immutable and cannot be changed without leaving a signature.

- Real-time

- Settlement is virtually done in real time rather than delayed batch files and lagging reconciliation.

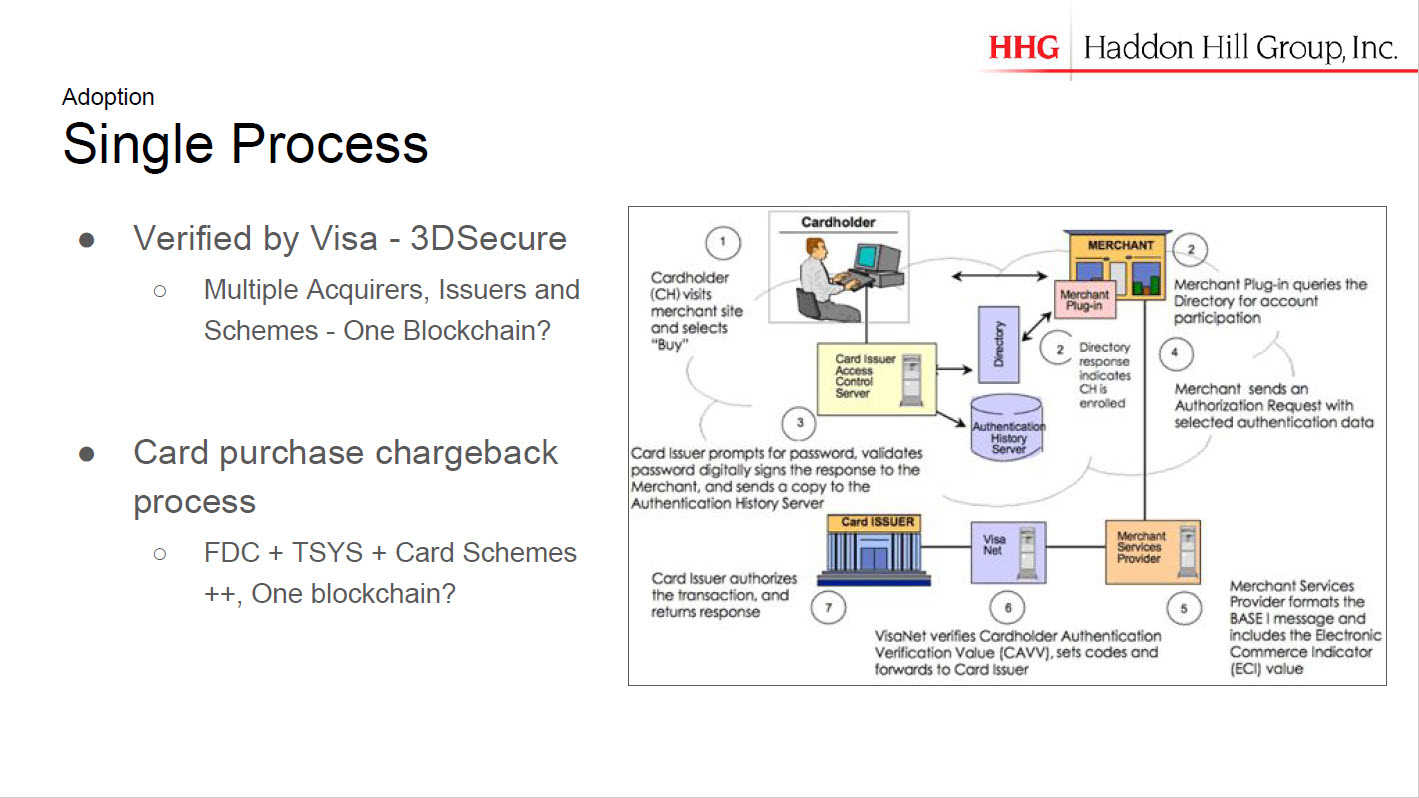

Examples of a single-process implementation

Robert went on to describe some finance use cases where blockchain could be applied as a single pub/sub queue. In this scenario, he mentioned two: Verified by Visa and credit card purchase chargeback processes.

In the context of Verified by Visa, he mentioned that “everyday there were literally thousands of batch files between the providers of 3DSecure, the issuing banks, and the acquiring banks.” So, if there was just one queue where everybody could read and write from, then “it would save hundreds of batch files” and hundreds of instances of working out each and every process.

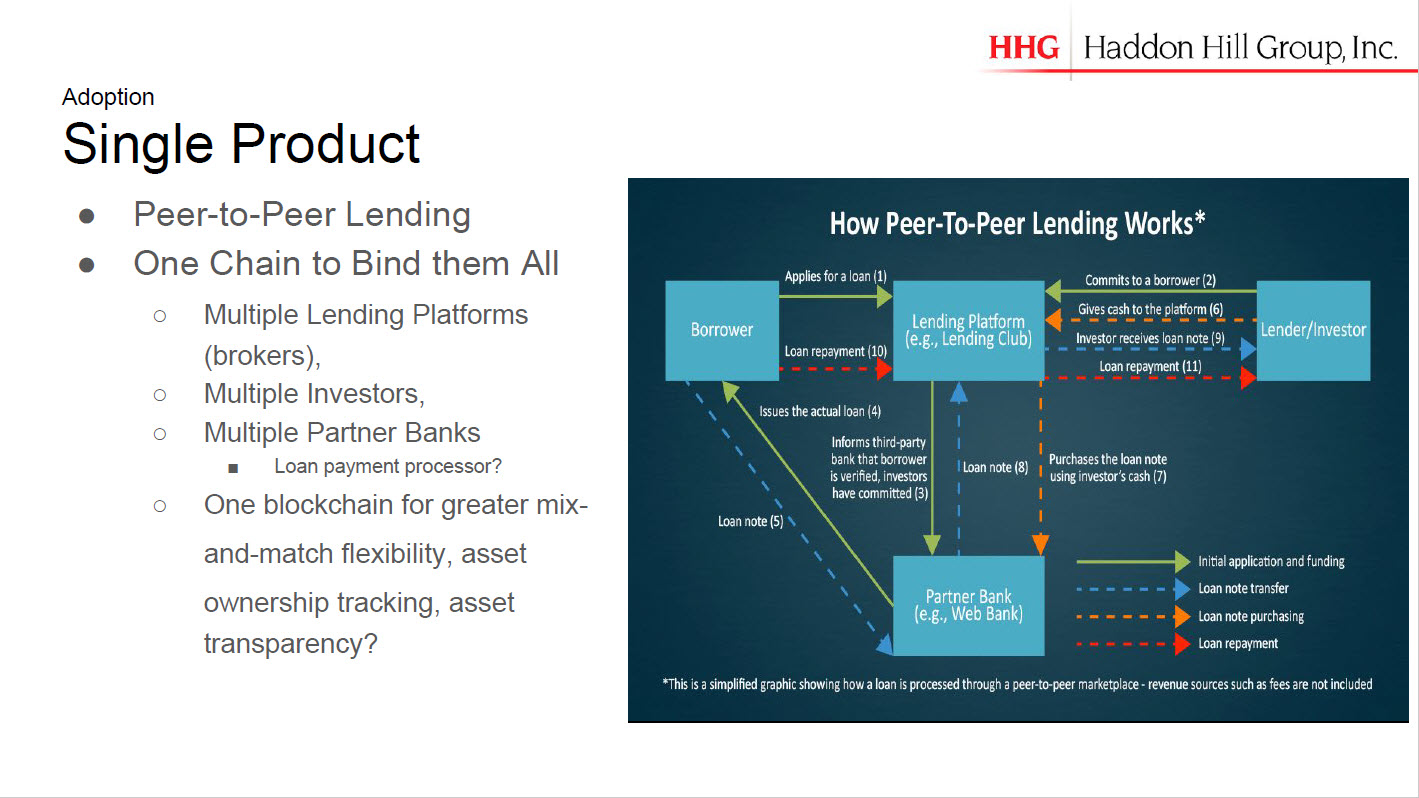

Moving on to another use case, Robert explained how blockchain could improve a peer-to-peer lending by extending its coverage to multiple investors, lending platforms, and partner banks. This would allow the participants to “mix and match their portfolios.”

Where this can be applied

Robert pointed out general finance processes where the single-process model could be adopted.

- Securities processes

- Trading and settlement, depository, lending, portfolio creation and balancing, and securitization processes have proofs-of-concept in the works that could lead to adoption.

- Global payments

- SWIFT rewrite of global payments and settlements systems based on need for more transparency and better security may lead to adoption.

- SWIFT’s reluctance opens the door for another global payment system to become a blockchain early adopter.

- Regulatory reporting

- Proof-of-delivery (nonrepudiation) and timestamping.

- Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) components of all financial processes.

- Regulatory arbitrage and avoidance

- Any process with highly variable regulatory and compliance costs could adopt blockchain.

“Imagine a world where everybody was honest, transparent, accurate, never changed their mind, and never tried to be somebody else…Blockchain gives you the tools for making the kind of thing possible.” —Robert Boyd

Apart from financial processes, there are financial organizations that could look to adopt blockchain:

- Integrated financial institutions

- “On Us” credit card processing

- Bank loan and payment processing

- Multi-tenant banking platform vendors

- Payment card schemes (Visa, MasterCard, etc.)

- Integrated Manufacturing

What about non-financial use?

Robert mentioned Let’s Talk Payments, where he found some use cases. According to him, “digging dipper into the non-financial use cases, they all look like publish and subscribe integration queues.”

With blockchains serving this way, Robert concludes that, “we can dial down the need for trust in third parties to do quite so much error and exception processing for us and keep it all in the blockchain.” Although one always needs trust in third parties, he believes that “maybe they become more the keeper of the blockchain as a way of having trust within the community.”

Want details? Watch the video!

Table of contents

|

Related slides

Further reading

- The Royal Bank of Scotland Builds a Hyperledger Digital Wallet: the Lessons Learned

- Blockchain Adoption: Industry Requirements and the Role of Prototypes

- What Is the Future of Blockchain?

- The Impact Blockchain Can Bring upon Finance and Banking and How It May Happen

- Blockchain Bottlenecks in Finance, Healthcare, and Insurance