CoreLogic Consolidates 700 Apps into 300 with Cloud Foundry

SaaS/analytics: Streamlining a complex IT infrastructure that had been built through years of acquisitions.

- Reducing number of apps from 700+ to 300

- Creating a pre-provisioned, multi-tenant common platform

- Abstracting the hardware and software infrastructure supported by IT

Meeting multiple challenges including:

- Creating a developer pilot program that embraces multiple app development technologies

- Rapid app hosting with no server provisioning

- How to build scale massively while being superefficient

A hybrid cloud composed of multiple infrastructures and data centers

Pivotal CF, Pivotal Big Data Suite

It cuts through a thicket of decades of IT development to create a modern, streamlined solution for tens of thousands of customers.

Headquartered in Irvine (CA), CoreLogic empowers clients in financial services and real estate to make smarter decisions through data-driven insights. The analytics services revolve around data derived from a host of public sources, as well as from CoreLogic’s proprietary databases.

The company’s roots date back to TRW and Experian. CoreLogic has access to over 40 years worth of financial and property data, which includes 99% of all U.S. property records.

(Note: This use case is based on a study first published at Pivotal.io.)

CoreLogic is the market-leading provider of comprehensive property information, real estate transaction services, and analytics for mortgage lenders and servicers, capital market investors, and real estate sales professionals.

The company combines publicly available data and multiple listing service (MLS) data with its own property, mortgage and financial databases to provide information required for mortgage and real estate services.

According to Richard Leurig, Senior Vice President, Innovation Development Center, CoreLogic, “Data is central to what we do. We collect data from public sources and from our clients and then use it to drive actual transaction processing, insights, analytics, and decision-making.”

CoreLogic has developed extensive technology applications and platforms to automate and streamline workflows, and today its cloud-based loan origination and asset management platforms offer flexible, convenient, and secure on-demand services for clients.

Information and analytics clients need

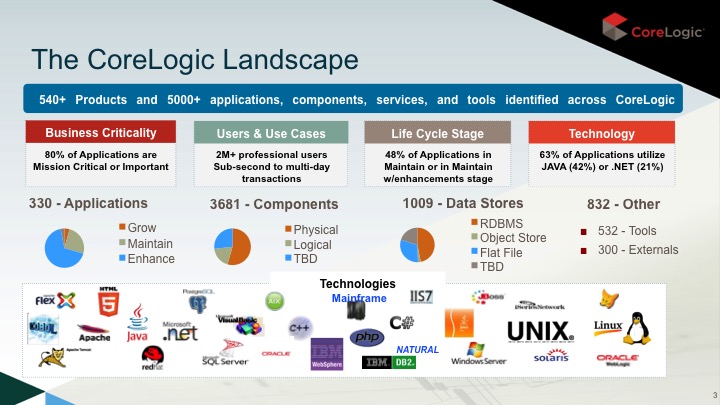

After years of growth through mergers and acquisitions, CoreLogic IT leaders realized they were supporting a complex enterprise infrastructure with siloed, outdated technology stacks and disparate datasets. The systems contained redundant data and were expensive and time consuming to maintain.

Today, software is the primary means for how CoreLogic delivers products to clients, but legacy systems and a lack of standards made it challenging to develop new applications to meet the evolving needs of clients.

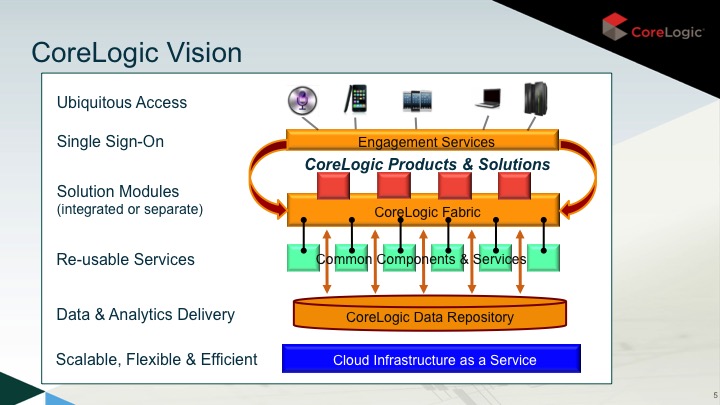

The company wanted to take advantage of its untapped, extensive data repository and use emerging technologies to quickly and easily build new and differentiated products. Their vision is to create products and services that leverage new mobile technologies and other platforms to give clients access to data and analytics in realtime to make better business decisions on a daily basis.

Preparing for a software-driven era

To modernize, reign in excessive costs, and improve application development agility, CoreLogic established the Innovation Development Center spearheaded by Leurig.

Because the company had already embraced software as a service, Leurig sought a hybrid cloud solution that would provide a standard set of development tools and a scalable, common platform for both infrastructure as a service and data as a service that runs both inside and outside their data center.

One goal was to consolidate 700+ applications down to approximately 300 to reduce maintenance costs and decrease data redundancy. A second goal was to establish an ecosystem that improves data management to facilitate innovation and drive faster product delivery.

In addition to cutting the number of apps by half, they wanted to build a hybrid cloud solution that would provide resources, development tools, and a platform to speed up product delivery, reduce maintenance expenses, and decrease data redundancy. CoreLogic also wanted to get the flexibility to move from one cloud provider to another without having to change anything.

[blockquote cite="Richard Leurig, Sr VP, Innovation Development Center, CoreLogic"]The next-generation platform means for us that we are providing a full ecosystem of common components and services that developers can utilize to build products quickly, swiftly, and fast on top of a platform that is running on multiple infrastructures and data centers without us having to rewrite the applications.[/blockquote]Additionally, as part of the CoreLogic Innovation Development Center, Leurig is actively creating standards and a common platform for both infrastructure as a service and data as a service. This will modernize and provide streamlined access to data, at the same time reducing excessive development costs.

Analytics and insights

The mortgage and financial services industries that CoreLogic serves are becoming more regulated, so it is critical that CoreLogic be able to provide the data and information clients need to navigate new compliance laws and regulations.

In addition, IT leaders at CoreLogic believe that the new data as a service functionality provided by Cloud Foundry will facilitate the blending of various data sources—something that was not really possible with their legacy systems—to create new products so clients can quickly access valuable analytics and insights to get the answers they need.

CoreLogic wants to enhance client experience by providing their users with data in realtime using the device or engagement model they prefer—whether it is a website or mobile device such as a tablet or smart phone.

This will enable their clients to make solid decisions while working in the field, including a realtor helping a home buyer purchase property in a specific geographic area or an underwriter making decisions about a property for insurance purposes. Also, the CoreLogic universal data platform will enable clients to access new analytics via visualization, reporting and dashboards to improve decision-making.

Related videos

In this video from the Cloud Foundry Summit 2014, Richard Leurig speaks about CoreLogic’s information delivery, design principles, and collaboration with Pivotal.

In the following video, Richard talks about CoreLogic’s vision and their next-generation platform that enables access to data in real time and helps developers to build products swiftly.

Related slides

Below, you can find Richard’s slides from the Cloud Foundry Summit 2014.