2016–2017 Trends: Blockchain Proliferation

All Trends | A “Varietal Cloud” and PaaS | Neo-AI and Neo-Luddism | Blockchain | Smart Cities | Industry 4.0 | Open Source

Trend #6: Blockchain proliferation

You have to be a blockhead if you didn’t pay attention to blockchain in 2016, doubly so if you continue to ignore it this year. Blockchains are proliferating like mad, with proponents of each new schema proclaiming theirs presents the best path to follow.

I understand why you may have ignored it, because the topic can seem inscrutable. Still, it’s time for all eyes to be open and focused at least some of the time on blockchain, which may revolutionize the geopolitical nature of the world forever, disrupt, and upend massive swaths of the world’s economic sectors, usher in a golden new era business and government transparency, or do absolutely nothing.

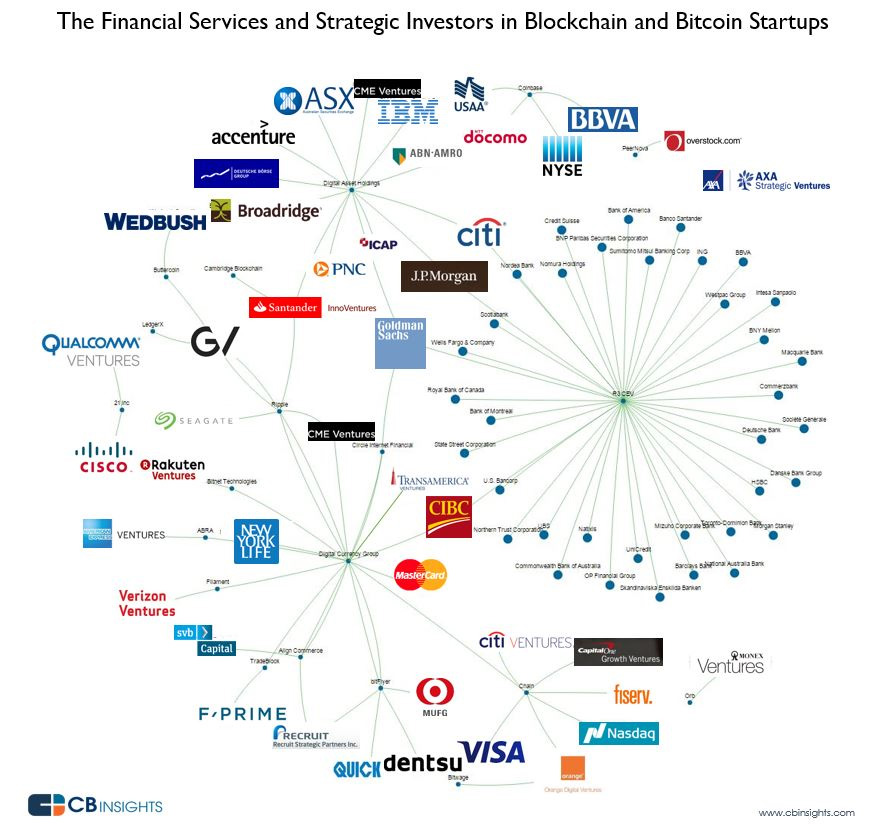

In 30 years of covering technology, I’ve not seen a technology so fraught with mystery and dichotomized opinions. The mystery comes from blockchain’s roots in the Bitcoin cryptocurrency, something that continues to defy conventional analysis. Is it really a key part of the future of finance? Can it be corralled by governments? Will it continue to spawn other cryptocurrencies? Sharp disagreements flow from these questions.

Source: CB Insights

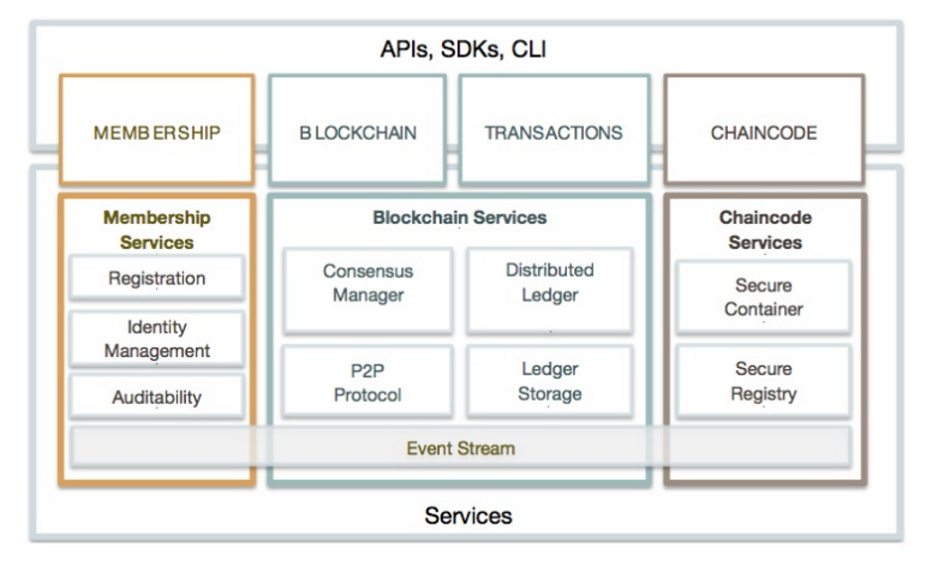

Source: CB InsightsHowever, the other side of the coin, so to speak, involves the type of blockchain found with the Hyperledger Project. We’ve written a lot about it over the past several months.

Blockchains like these can be described as public, anonymous (or “permissionless”), with a “proof of work” required to validate transactions. The proof in this case is solving a cryptographic hash challenge, something that now takes quadrillions of tries (which seems to approach the odds of a quantum fluctuation allowing me to walk through a wall).

Heading to more stable ground

The ground seems intuitively more stable in the world of private, permissioned blockchains. Transactions are validated by trusted members of the network through less onerous processes (with no cryptocurrency involved).

There are several blockchain projects underway in the world at the moment.

Despite this proliferation within this “safer” realm, I’m often struck by the notion that the seemingly safe move can actually be the one with the most risk. The concern with private blockchains is they may be solutions in search of problems. Even blockchain enthusiasts of a recent panel at a Hyperledger meetup in New York picked up on this thought.

It is safe to say that there is progress with private blockchain. Members of the panel referenced above also addressed the issue of how the Proofs of Concept (PoCs) of 2016 should evolve into tangible projects in 2017. Some momentum can be expected as Hyperledger Fabric moves into its formal v1.0 release, a topic discussed by leading proponent Arnaud Le Hors of IBM at another recent blockchain event.

Source: IBM Research, Zurich

Source: IBM Research, ZurichDoes blockchain change everything?

It’s also easy enough to find “blockchain changes everything” articles and tweets. The intent of such articles seems to try to scare people and their companies into going down a blockchain path, with or without a clear purpose and vision. Doing so will lead to many unnecessary failures and hurt the cause of useful blockchain initiatives, whatever they may be.

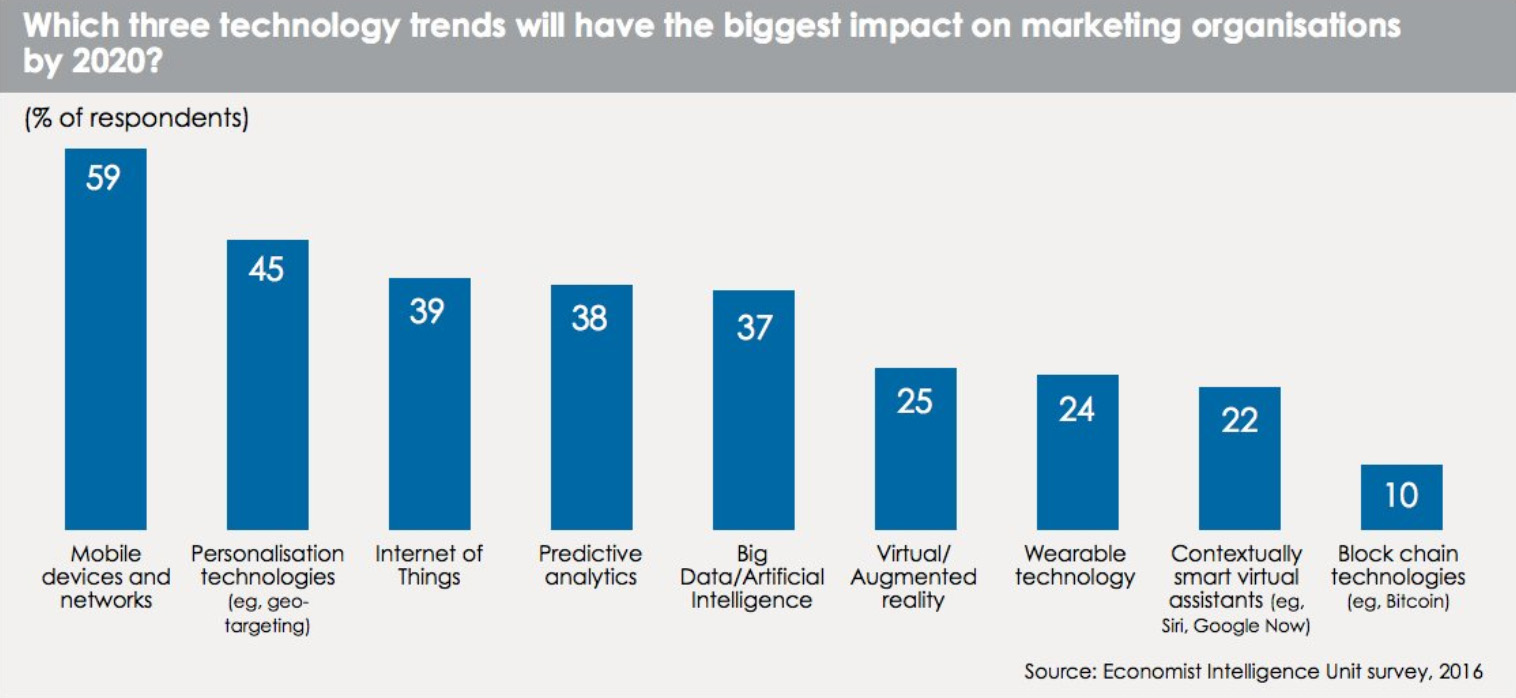

So, perhaps, my fears are unfounded. For example, a review by the Economist Intelligence Unit found that 10% of enterprise executives expect to use blockchain by 2020, ranking it last among eight technologies surveyed. Use of the word “Bitcoin” in this particular survey no doubt dampened enthusiasm among this crowd. In any case, one must ask, is the glass 1/10th full or 9/10ths empty?

Source: Economic Intelligence Unit

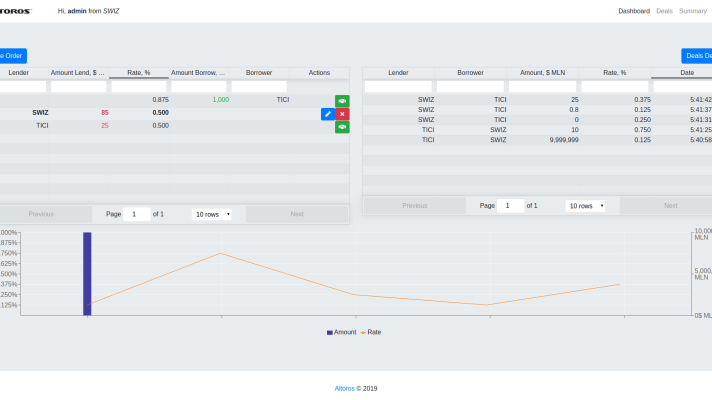

Source: Economic Intelligence UnitThere are financial services groups, including the R3CEV project, experimenting with private blockchains.

Beyond that, what can we expect in the short term? My opinion is that there are a few great potential uses of private blockchain:

- To create virtualized markets for agricultural goods in developing nations. One notable effort in this field has been in progress for the past few years, led by MIT Resident Entrepreneur Julius Akinyemi. One can see the potential of this type of project throughout the developing world.

- To create electricity microgrids in all parts of the world. There is a well-known effort in Brooklyn, New York. One can also imagine this to be a great idea for villages in the developing world, as well as urban grids like Brooklyn throughout the world. Altoros won a hackathon in this field in May.

- To create rental networks for medium to heavy tools and equipment. This sort of network could feature large numbers of one-time and other infrequent customers, so is not a closed system of a small number of institutions. However, registration would be required, reputation could be built in, and they would function in the manner of eBay.

The world is round

Finally, it’s worth noting the international collaboration that’s part of the blockchain picture. Three startups from Japan, for example, are sending people to Silicon Valley and New York to create “a bridge to innovation.” One of them, Soramitsu, is behind the Iroha mobile blockchain incubation that’s part of the Hyperledger Project.

The Hyperledger Project has a Twitter account, as well as @Ethereum, providing numerous useful updates. Altoros is also following things through the @LedgerBeat account, which has a large Hyperledger component but follows other blockchain developments, too. All of these can lead you to many other useful accounts if you’re interested in divining new insights about the mysteries of this faith.