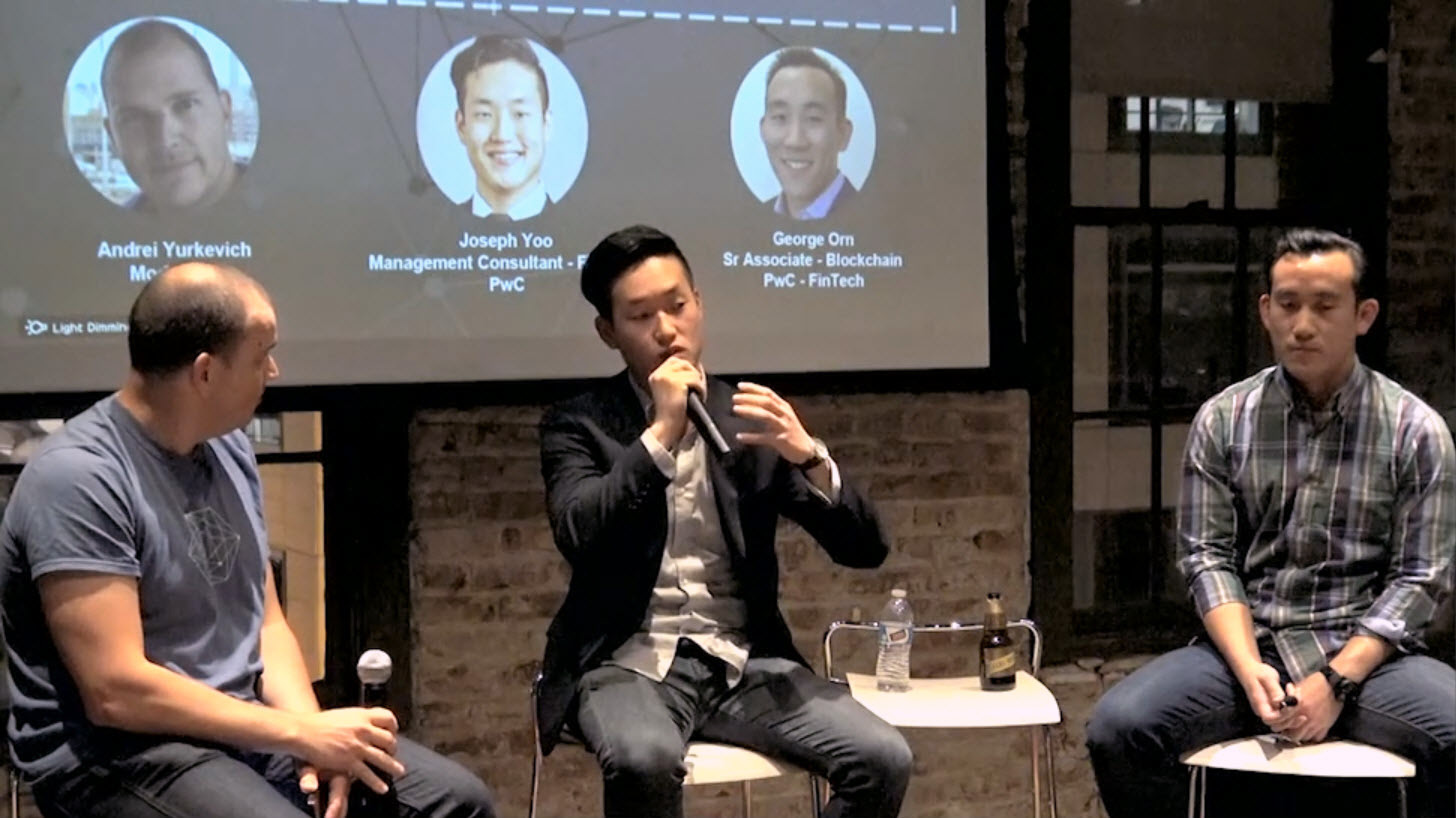

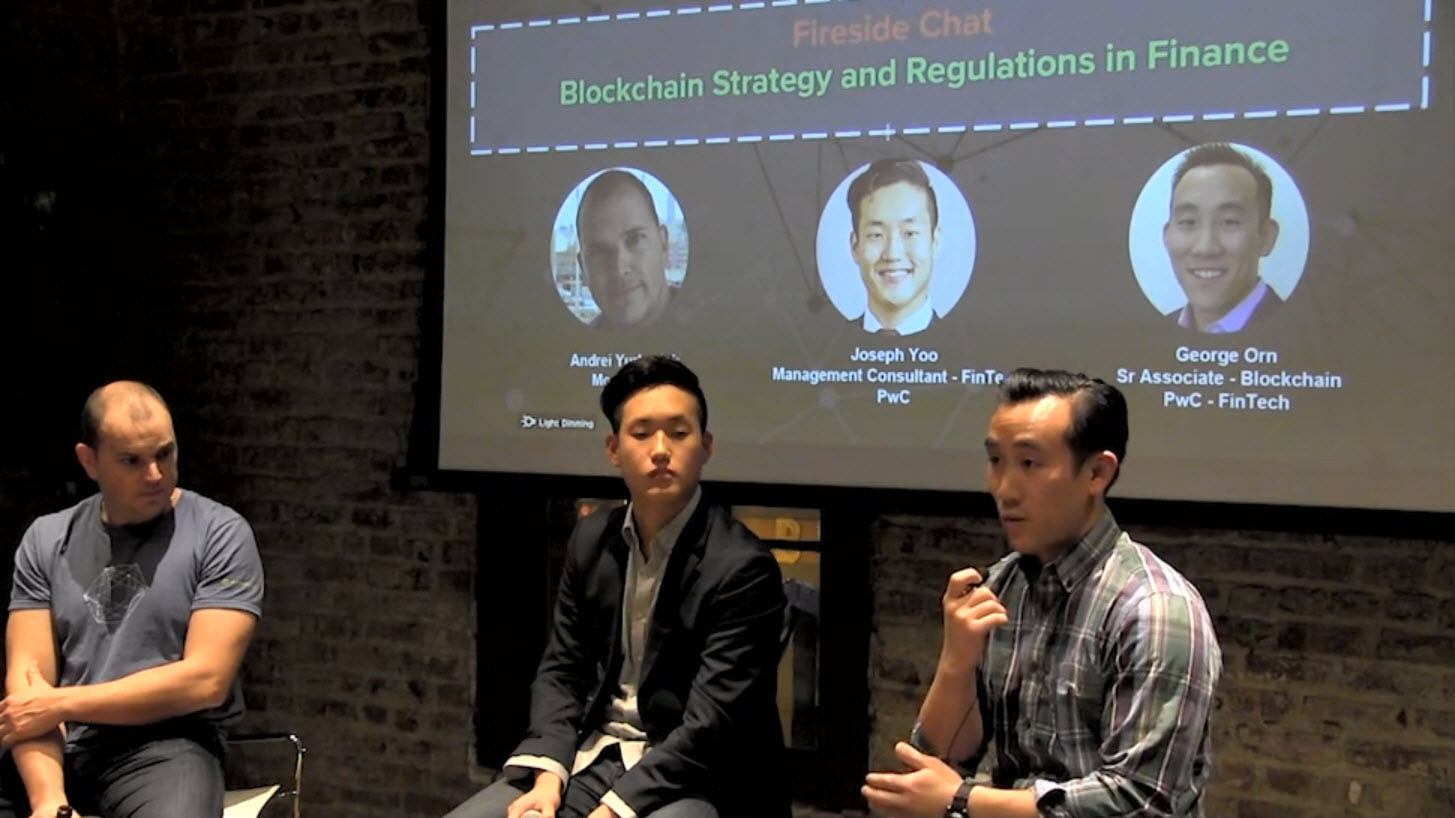

A Panel: Blockchain Introduces Opportunities in Identity Management

Blockchain as a tool for identity management in underbanked countries was one of the suggested uses for the technology at a recent Hyperledger meetup panel in San Francisco. The discussion included PwC’s Joseph Yoo and George Orn and was moderated by Altoros’s Andrei Yurkevich.

What’s the problem with identity?

According to ID2020, a non-profit corporation aligned to the U.N.’s Sustainable Development Goal 16.9, about one-fifth of the world’s population do not have a legal identity. Having a legal identity is a basic human right and not having one restricts a person’s access to such essential services and functions as:

- Healthcare

- Education

- Government assistance programs

In addition to those listed above, having no legal identity severely limits a person’s access to financial services like simply having a bank account.

“One of the social problems that we’ve been noticing is that people in underbanked countries don’t have a financial structure that they can build wealth upon. Even if they have a piece of land with a house built on top of it, because of the unsafe nature of the country they’re based in, that land can be taken away from them the next day,” said Joseph.

“This would not be a good structure to build upon and if they don’t have wealth they can’t demand other financial products at the end of the day. It feels like a foundation layer needs to be established for underbanked countries to demand more financial products.”

“Underbanked people are the primary audience that doesn’t have identity currently.”

—Joseph Yoo, PwC

Without financial services, a person’s economic growth also becomes limited. As Joseph pointed out, this can be an issue in a remittance scenario, where “some countries don’t have a digital identity in a secure platform. They lack the certainty of knowing that someone sending money from the U.S. is actually going to somebody in an underbanked country and to an actual person.”

Where does blockchain come in?

George mentioned an interesting statistic wherein about 80% of underbanked people don’t have a bank account but have access to mobile phones. While not quite 80%, Pew Research Center has a detailed report on smartphone ownership in emerging economies.

There are already companies running blockchain payments through mobile phones, so developing an official identity around that is within the realm of possibility. The problem now is how do we define a person’s identity in the blockchain?

“Are you going to tie their DNA to a blockchain? Are you going to tie their fingerprints to a blockchain?” asked George. “Sometimes facial features or fingerprints change over time. How can we contain that?”

“The real crux at this point is what are the standards for someone’s identity?” —George Orn, PwC

Standards and security

While the idea is sound, it all boils down to cooperation and reaching a consensus standard. If we’re talking about developing secure digital identities that are official and legal, then governments will need to weigh in on the discussion.

Regardless of the standard, the platform will need to be secure. Identities have been stolen before and Bitcoin has already been hacked.

Want details? Watch the video!

Table of contents

|

Related reading

- A Panel: Cooperation Is Key for Blockchain Development in Finance

- A Panel: How Soon Will We See Blockchain in Finance?

- Opinion: The Impact Blockchain Can Bring upon Finance and Banking and How It May Happen

- Managing Risk and Building Trust for Blockchain in Finance

About the speakers